Blockchain Technology Explained: A Clear Guide for Beginners

Advertisements

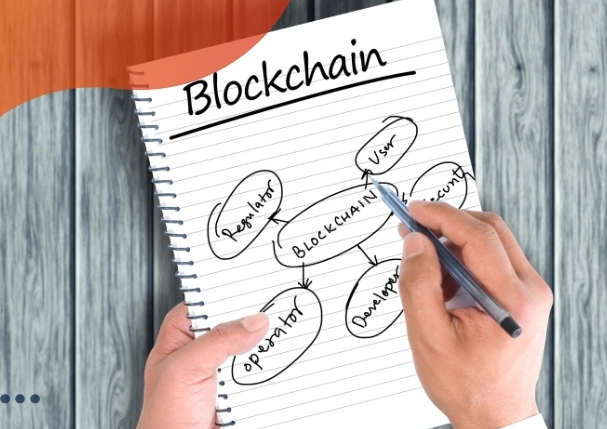

Let's cut to the chase. At its heart, blockchain is a decentralized digital ledger. That's the core idea everyone needs to grasp first. Forget the price charts and the hype for a second. Imagine a shared Google Sheet, but one where no single person or company controls it, every change is permanently recorded and visible to everyone, and it's nearly impossible to secretly alter past entries. That mental model gets you 80% of the way there. This technology is the engine behind Bitcoin, but its potential stretches far beyond digital money into areas like supply chains, contracts, and digital identity.

Your Quick Navigation Guide

What Is Blockchain, Really? A Simple Analogy

Picture a public library for transactions. Instead of books, it holds records of exchanges—"Alice sent Bob 1 Bitcoin," "Company X received shipment Y." This library (the ledger) isn't owned by a government or a bank. Copies of it exist on thousands of computers (nodes) worldwide.

When a new transaction happens, it's announced to the network. Special nodes called miners (or validators in newer systems) compete to bundle this new transaction with others into a "block." They solve a complex cryptographic puzzle to do this, which takes work and electricity. The winner gets to add the new block to the chain of previous blocks—hence, blockchain.

Here's the crucial part. This new block contains a unique fingerprint (hash) of the previous block. Change anything in an old block, and its hash changes, breaking the link to all subsequent blocks. To successfully cheat, you'd need to redo the proof-of-work for that block and every block after it, on more than half of all network copies simultaneously. On a large network like Bitcoin's, that's computationally impossible. This creates immutability.

I remember explaining this to a friend who runs a small business. His eyes lit up not at "decentralization," but at "immutable record." He immediately thought of contract disputes and supply chain receipts. That's the practical hook.

The Core Concepts That Make It Tick

Let's unpack the jargon. These aren't just buzzwords; they're the functional pillars.

Decentralization vs. Centralization

This is the biggest shift. Your bank's ledger is centralized. They control it, you trust them. A blockchain ledger is distributed across a peer-to-peer network. No single point of failure. If one node goes down, the network persists. This removes the need for a trusted intermediary, but it introduces complexity and, frankly, sometimes slower transaction times.

Consensus Mechanisms: How Agreement Is Reached

How do all these independent nodes agree on which transactions are valid? That's the job of the consensus mechanism. Proof-of-Work (PoW), used by Bitcoin, is the original. It's secure but energy-intensive. Proof-of-Stake (PoS), used by Ethereum 2.0, is different. Here, validators "stake" their own cryptocurrency as collateral to vouch for new blocks. It's faster and uses far less energy. PoS isn't inherently better or worse—it's a trade-off between different security and efficiency models.

Transparency and Pseudonymity

On a public blockchain, all transactions are visible. You can look up any wallet address and see its entire history. But wallet addresses are strings of letters and numbers, not directly linked to real-world identities (pseudonymity). This creates a unique dynamic: complete transactional transparency without necessarily knowing who's behind each address.

| Feature | Traditional Centralized Database | Public Blockchain |

|---|---|---|

| Control | Single entity (e.g., a bank, company) | Distributed network |

| Data Alteration | Possible by the controlling entity | Extremely difficult, requires network consensus |

| Transaction Speed | Very Fast (thousands per second) | Slower (Bitcoin: ~7/sec, Ethereum: ~15-30/sec) |

| Trust Model | Trust in the central authority | Trust in the code and cryptographic protocol |

| Best For | High-speed, private data processing (e.g., social media feeds) | High-value, high-trust scenarios where auditability is key |

Beyond Bitcoin: Smart Contracts and Real Uses

If Bitcoin showed the world the ledger, Ethereum introduced the programmable ledger. This is where it gets interesting for developers and businesses.

A smart contract is just a piece of code stored on the blockchain that runs automatically when predetermined conditions are met. Think "if-then" statements with real-world consequences. For example: "IF the delivery GPS data shows the container arrived at the port, THEN automatically release payment to the supplier."

The code executes exactly as written. No waiting for a bank to process wires, no manual invoices. This automation reduces cost and friction, but it introduces a new risk: the code is law. A bug in the contract can have irreversible consequences, as seen in several high-profile exploits.

Where is it being used now?

- Supply Chain: IBM Food Trust lets retailers like Walmart track produce from farm to shelf, drastically reducing the time needed to trace contamination sources.

- Finance (DeFi): Decentralized Finance platforms allow lending, borrowing, and trading without a bank, using smart contracts as the intermediary. Platforms like Aave or Uniswap are examples.

- Digital Identity: Projects like Microsoft's ION are working on giving individuals control over their digital credentials (diplomas, licenses) via decentralized identifiers (DIDs) on a blockchain.

- Digital Ownership (NFTs): While often associated with digital art, the underlying principle is a blockchain-based certificate of authenticity and ownership for any unique digital (or physical) asset.

The Good, The Bad, and The Overhyped

Let's be balanced. This tech isn't magic.

The Advantages:

- Enhanced Security & Immutability: The cryptographic linking of blocks makes fraud and retrospective alteration incredibly difficult.

- Transparency & Auditability: Every step is recorded on a shared ledger, perfect for auditing and compliance.

- Reduction of Intermediaries: Can cut out middlemen, potentially lowering costs and speeding up processes.

- Increased Trust: In systems where participants are wary of each other, the trust is placed in the neutral protocol.

The Disadvantages & Challenges:

- Scalability Issues: Public blockchains often struggle with transaction speed and volume compared to centralized systems. Ethereum's high "gas fees" during peak times are a symptom.

- Energy Consumption (of PoW): Bitcoin's mining process uses significant electricity, a major environmental concern. (Though it's worth noting the World Bank and others report a growing use of renewable energy in mining).

- Irreversibility: Mistakes are hard to fix. Send crypto to the wrong address? It's likely gone forever.

- Integration Complexity: Integrating legacy business systems with blockchain networks is non-trivial and expensive.

- Regulatory Uncertainty: Governments are still figuring out how to regulate this space, creating risk for businesses.

Where Is This All Going? Future Trends

The evolution is moving away from "one-chain-fits-all." We're seeing:

Layer 2 Solutions: These are protocols built on top of a base blockchain (Layer 1) to handle transactions off-chain before settling on-chain. Think of them as express lanes on a highway. The Ethereum Foundation highlights solutions like Optimistic Rollups and zk-Rollups to scale the network.

Interoperability: The future is multi-chain. Projects like Polkadot and Cosmos are creating frameworks for different blockchains to communicate and share value seamlessly.

Enterprise Adoption: More private, permissioned blockchains for specific business consortia (like a group of banks or shipping companies) where participants are known and trusted, but a shared, immutable ledger is still valuable.

The technology is maturing. The wild west phase is giving way to more focused, practical infrastructure building.

Your Blockchain Questions, Answered

Is a blockchain the same as Bitcoin?

What's the biggest practical risk when using a smart contract?

Can I use blockchain technology without buying cryptocurrency?

Why is blockchain considered slow and inefficient for some tasks?

Leave A Comment